Mortgage interest rates may decline in response to cooling inflation numbers.

Getty Images/iStockphoto

Mortgage interest rates may decline in response to cooling inflation numbers.

Getty Images/iStockphoto

There were some encouraging economic developments this week that millions of Americans likely warmly welcomed. The unemployment rate in January, for example, declined to 4.3% as employers added more than 100,000 jobs, a Wednesday report revealed. And Friday brought positive news on the inflation front as that rate also dropped, from 2.7% to 2.4%. That puts inflation closer to the Federal Reserve's target 2% goal, and it will help keep costs in check for Americans, even if inflation overall is still increasing year over year, just at a slower pace.

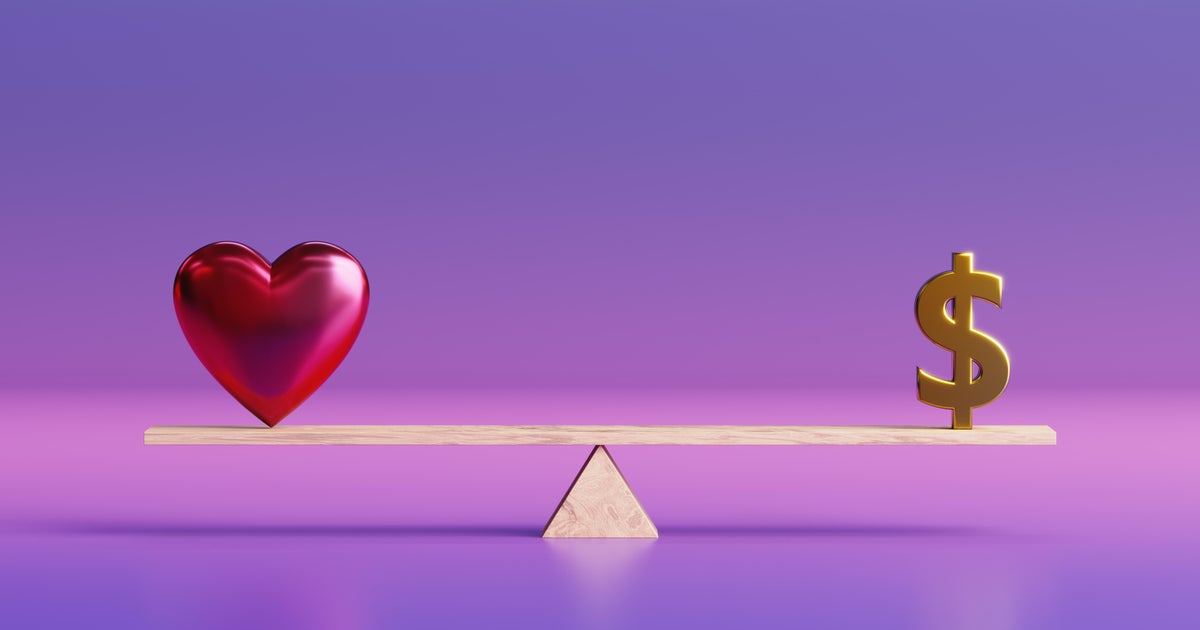

These changes don't happen in a silo, however, as they can and will reverberate throughout the wider economy. The question for homebuyers and current owners hoping to refinance, then, is what this will now mean for mortgage interest rates, specifically. After surging to their highest level since 2000 in 2023, mortgage rates have gradually but noticeably declined since. At the start of 2026, mortgage rates could easily be found under 6% and, in recent days, qualified borrowers may have even been able to find rates closer to 5%.

But will they fall further now that inflation is back on the decline? The answer may be more nuanced than you'd expect.

Start by seeing how low your current mortgage rate offers are here.

Will mortgage rates fall now that inflation is declining?

Inflation and mortgage interest rates don't always move in the same exact direction, though they do often reflect similar dynamics. So, yes, an inflation decline can theoretically result in lower mortgage interest rates, but there's more involved than the former directly impacting the other.

Lower inflation can encourage the Federal Reserve to issue additional interest rate cuts, and that, in large part, can then support lower mortgage interest rates. This was the dynamic that many borrowers noted in the final months of 2024 and 2025, as lower inflation then supported interest rate reductions on behalf of the central bank. That said, there is no Federal Reserve meeting on the calendar again until March 17, so a cut, even if it is issued, is more than a month away.

At the same time, mortgage lenders take direction from the Fed, but they aren't dictated by it. In other words, they don't need to wait for a formal rate reduction to preemptively start offering lower rates to borrowers. And many will not, hence the reason why borrowers may see better rates here both today and in the days to come.

But don't forget that mortgage interest rates are driven by a complex combination of factors, of which the inflation rate and the Fed's rate position are just two. Remember, also, that unemployment just declined, which could encourage the bank to actually keep rates steady as they often cut in response to poor unemployment news, not positive developments. Other factors, like the 10-year Treasury yield, can also influence mortgage interest rates, sometimes in a way that appears contradictory compared to what's happening elsewhere.

All of this is to say that, yes, today's cooler inflation rate can impact mortgage interest rates in a downward direction, but it won't necessarily be direct. Other factors can also mute that impact, perhaps considerably. Consider, then, shopping around to see how low your current rate offers actually are right now. With some time spent speaking with lenders and reviewing online marketplaces, you can get a better idea of inflation's impact and, more importantly, accurately determine if today's rates truly justify making a move.

Explore mortgage rates, lenders and terms all in one place here.

The bottom line

A lower inflation rate can and often will mean a slightly lower mortgage interest rate, which is good news for borrowers now that inflation just dropped again. But the relationship between the two is complex and not always linear, so be sure to take a broad look at all of the factors impacting mortgage rates to better determine when it's worth acting and when it's worth holding back. Still, today's inflation news isn't bad for buyers and owners hoping to refinance, either, and it could be enough of an influence to move rates enough to justify a purchase or refinance. Reach out to a mortgage lender who can answer your questions and better help you determine when to submit an application.

Edited by Angelica Leicht